Amazon’s AI chatbot, Rufus, saw a dramatic jump in usage on Black Friday as consumers increasingly turned to AI to discover deals and compare products. New data published by Sensor Tower shows that Amazon sessions involving Rufus and resulting in a purchase surged 100%, compared with the trailing 30-day average, while non-Rufus sessions with purchases rose only 20%.

Day-over-day growth tells a similar story: purchase-resulting sessions that used Rufus increased 75%, while those without Rufus rose just 35%.

Overall, website traffic also shifted toward AI-supported browsing. Total Amazon sessions grew 20% on Black Friday, but those that involved Rufus rose 35%.

Launched broadly in the U.S. in late 2024, Rufus now assists shoppers with product discovery, comparisons, and recommendations.

AI Shopping Traffic Exploded Across Retail

The surge in Rufus adoption reflects a larger trend: consumers are turning to AI en masse for holiday shopping.

Adobe Analytics, which tracks over 1 trillion U.S. retail visits, reported an 805% year-over-year increase in AI trafficto retail websites on Black Friday — a massive shift toward generative AI tools for deal-hunting and research.

AI was most commonly used to shop for electronics, gaming, appliances, toys, and home goods. Adobe also found AI-referred shoppers were 38% more likely to buy compared with non-AI traffic.

Whether these tools drove Black Friday’s record $11.8 billion in online spending remains unclear. High spending may instead reflect rising prices: Salesforce data shows average online prices were up 7%, while order volume actually fell 1%.

Sensor Tower added that, despite strong holiday spikes, overall consumer spending appears more cautious this year. App downloads and total website visits increased over the prior month but grew more slowly than in 2024.

For example:

- Amazon app downloads were up 24% (versus 50% in 2024)

- Walmart app downloads grew 20% (versus 75% in 2024)

- Amazon and Walmart website visits rose by 90% and 100% (compared with 95% and 130% in 2024)

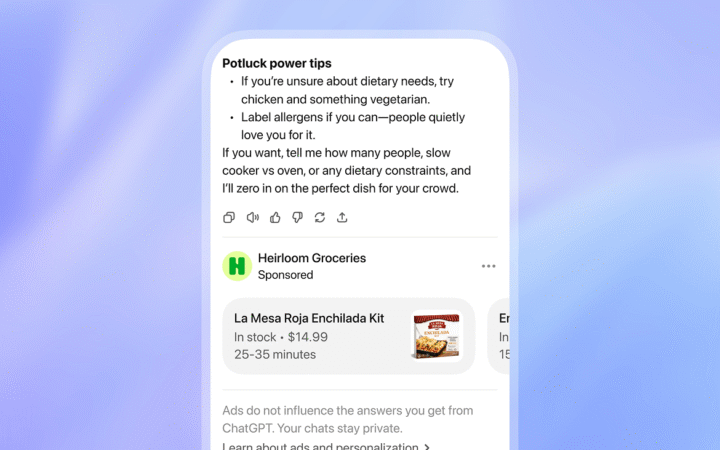

In addition to Rufus, several major platforms recently rolled out new AI shopping solutions. OpenAI and Perplexity both launched AI-assisted shopping features, allowing users to get tailored recommendations, product comparisons, and deal hunting via chat. Meanwhile, vertical-specialist tools such as Onton and commerce platforms like Shopify have also embraced agentic AI commerce — offering specialized product curation, AI-driven storefronts, and automated shopping assistance.

The growing number of these tools helps explain why many consumers turned to AI this Black Friday — and why conversion rates for AI-driven shopping exceeded those of traditional retail traffic.