Billionaire investor Peter Thiel has sold his entire stake in Nvidia Corporation, filings show, as concerns mount over an AI-fueled tech valuation bubble. According to a Form 13F filing from his Thiel Macro fund, Thiel sold 537,742 shares between July and September, totaling nearly $100 million, and held no Nvidia shares as of September 30.

Thiel also reduced his holdings in Tesla from 272,613 to 65,000 shares while acquiring stakes in Apple (79,181 shares)and Microsoft (49,000 shares). He fully exited Vistra Energy, selling 208,747 shares.

Thiel’s divestment follows similar moves from SoftBank Group and comes shortly after investor Michael Burry disclosed large short positions on Nvidia and Palantir. Thiel had previously warned about stretched Nvidia valuations, comparing recent tech market trends to the 1999–2000 Dotcom bubble.

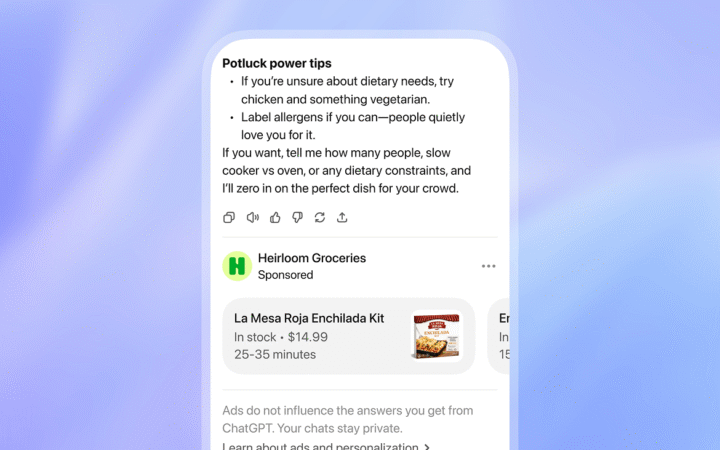

The sale underscores investor apprehension over AI-related spending and financing, particularly concerning Nvidia’s role as a major supplier to OpenAI, and broader capital expenditure increases among megacap tech firms. Analysts note these developments highlight growing skepticism about the sustainability of AI-driven growth and valuation levels in the semiconductor and AI sectors.