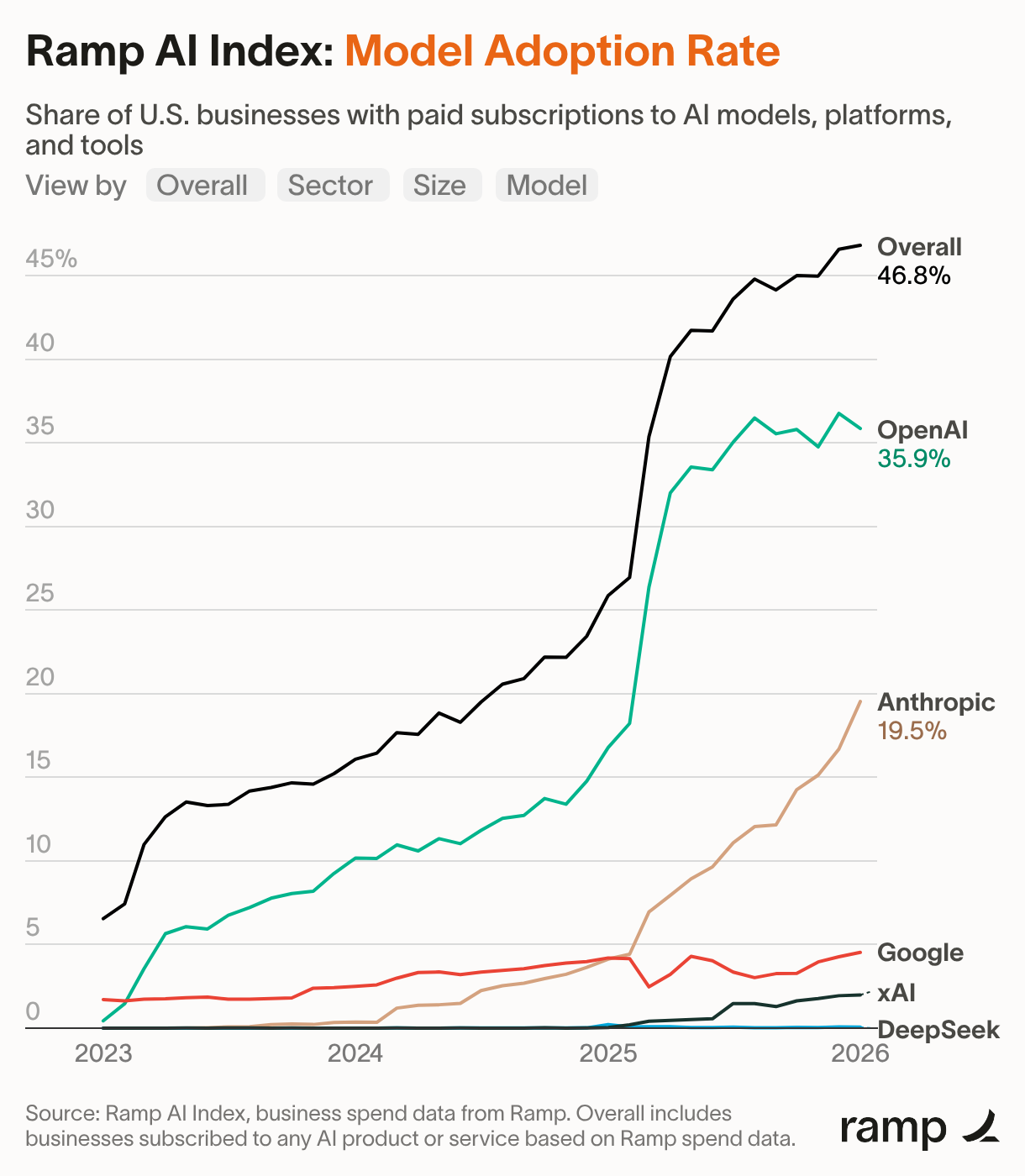

Business adoption of AI tools rose to a record 46.8% in January, according to the latest Ramp AI Index. The report highlights a notable surge in Anthropic adoption, which grew from 16.7% to 19.5% of businesses. This represents one of the largest monthly gains Ramp has recorded, meaning roughly one in five companies now pays for Anthropic products – up from one in 25 a year ago.

This growth comes alongside a recent landmark funding event, in which Anthropic raised $30 billion at a $380 billion valuation, fueled by strong demand for its Claude AI models and rapid enterprise adoption.

Meanwhile, OpenAI adoption slipped slightly from 36.8% to 35.9%, giving back some of the gains recorded in the previous month. Google remained steady at 4.5%. These trends raised questions about whether Anthropic is capturing market share from OpenAI.

Source: Ramp AI Index, business spend data from Ramp. Overall includes businesses subscribed to any AI product or service based on Ramp spend data.

Multi-Vendor Adoption Drives Growth

Ramp’s analysis rules out widespread switching from OpenAI to Anthropic. Both providers maintain similar churn rates, around 4% per month. If companies were cancelling OpenAI subscriptions in favor of Anthropic, OpenAI’s churn would be noticeably higher, which it is not.

Instead, the data points to multi-vendor adoption. About 79% of Anthropic customers also pay for OpenAI services. This indicates that most new Anthropic users are existing AI adopters adding a second provider rather than replacing OpenAI. Businesses appear to be experimenting with multiple AI tools to support different teams and tasks, such as engineering, sales, or other workflows.

Today, 16% of businesses pay for both OpenAI and Anthropic, up from 8% a year ago. This overlap metric, often overlooked in simple market share analyses, may be the most important indicator of how AI adoption is evolving. It reflects a market that is still expanding rather than consolidating, with companies trying multiple providers in parallel.

Implications for the AI Market

The Ramp data suggests the current AI adoption landscape is not zero-sum. Companies are buying multiple AI tools simultaneously, giving different teams access to models suited to their specific needs. Over time, some consolidation may occur as businesses optimize their AI stacks, but for now, multiple providers can grow together.

For executives and investors, the findings underscore the importance of tracking both adoption rates and overlap metrics. Rising multi-vendor adoption indicates businesses are experimenting and building internal expertise with AI, which could shape long-term vendor selection and product strategy.